Simple and Easy Way to Interpret Options Open Interest

See what's inside

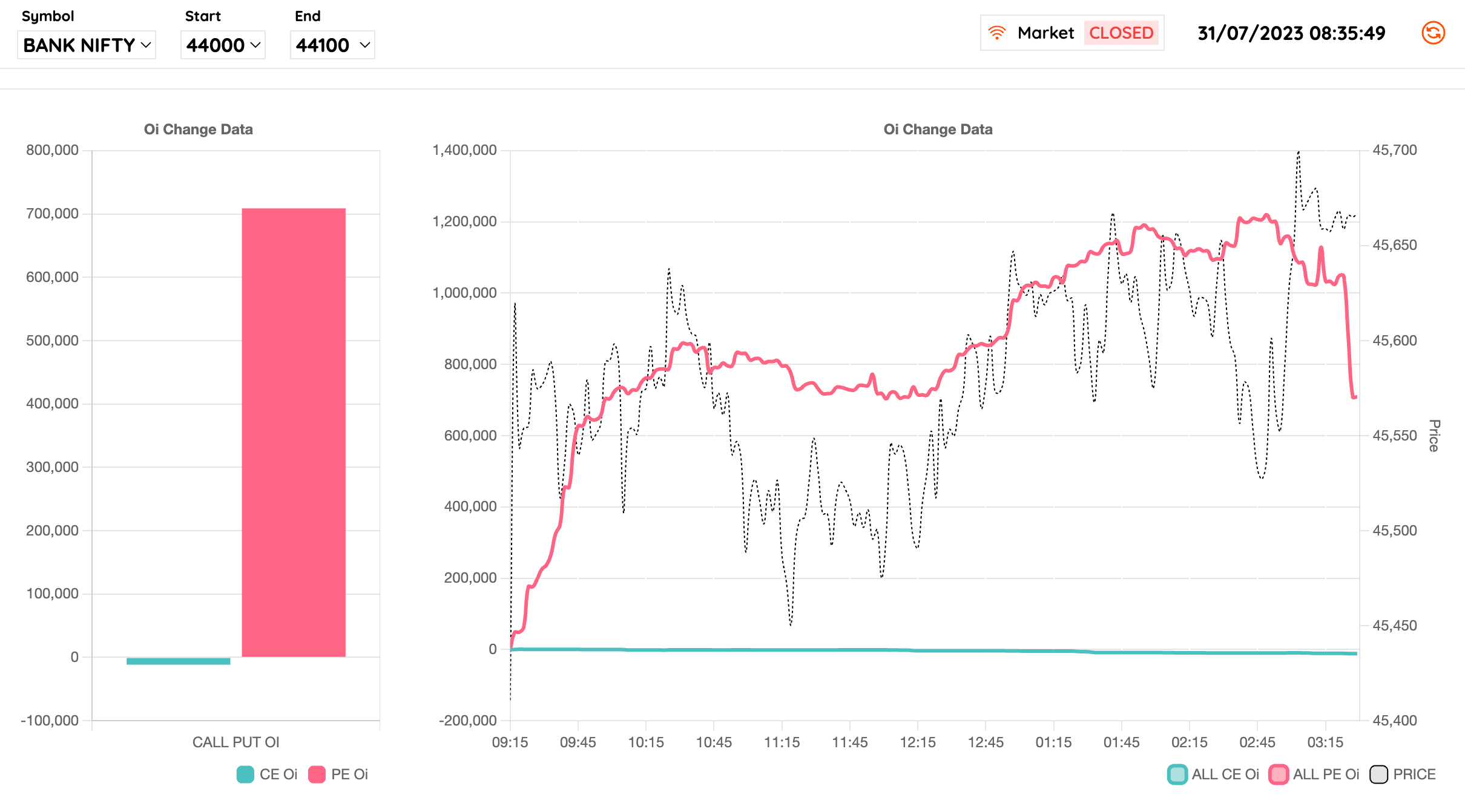

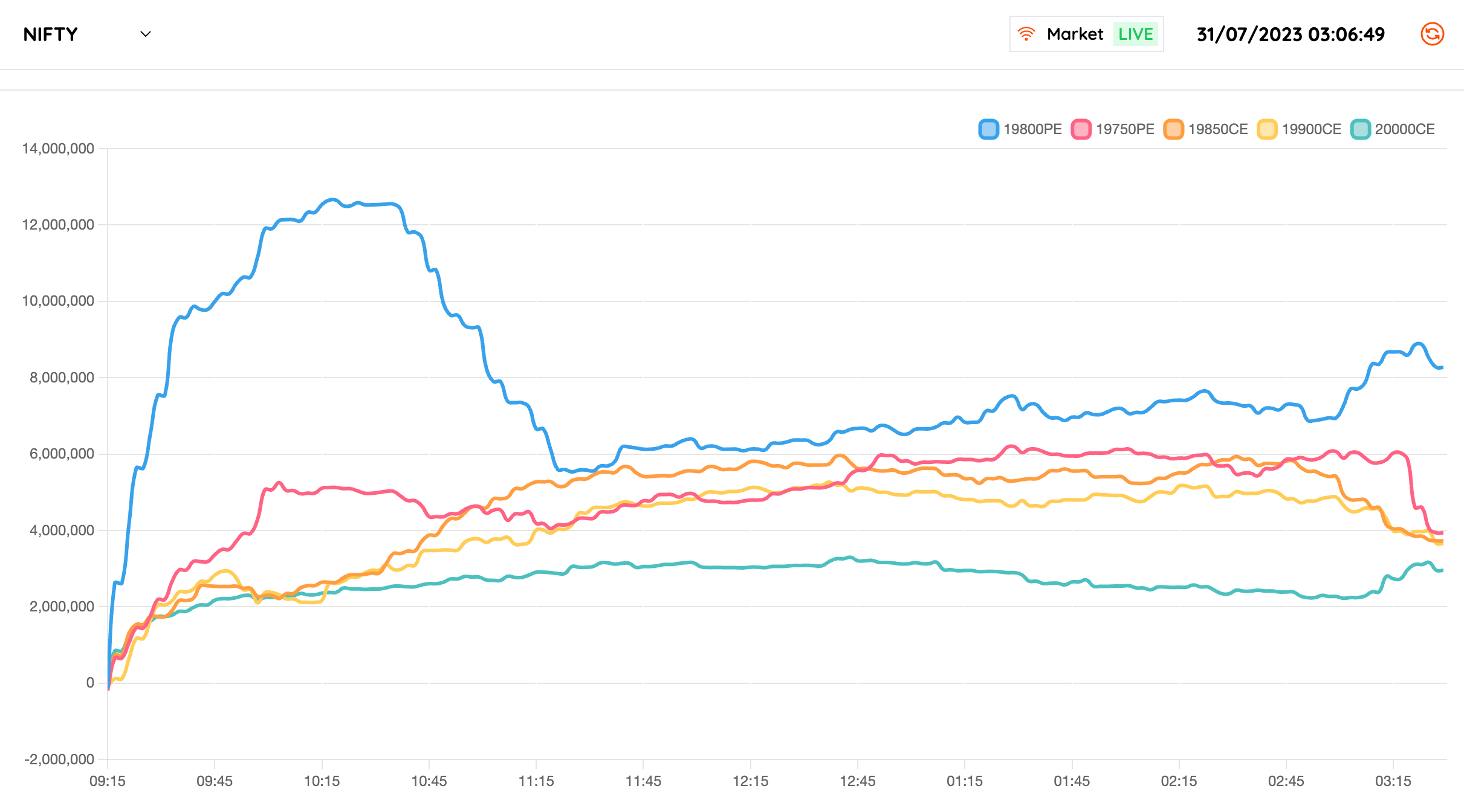

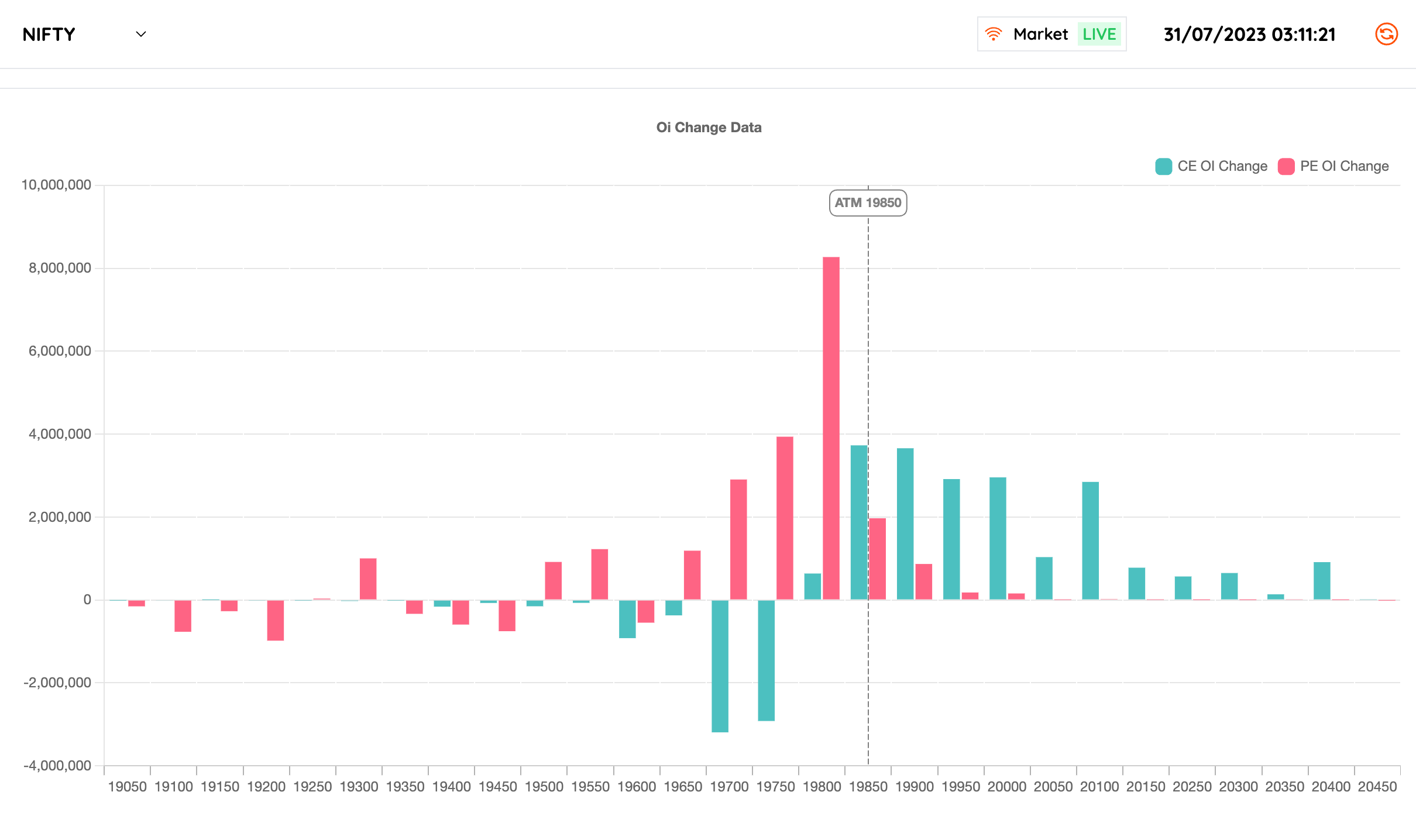

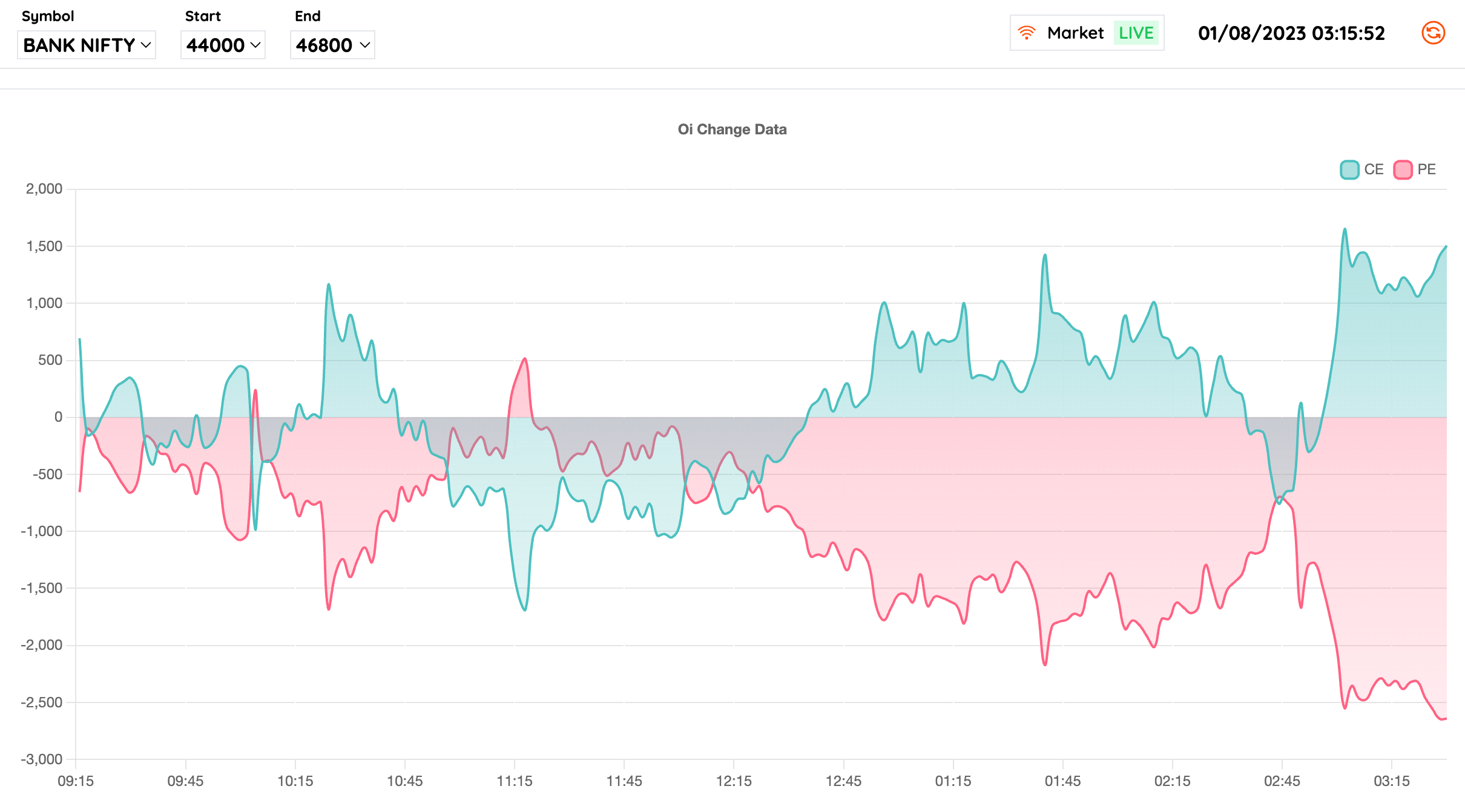

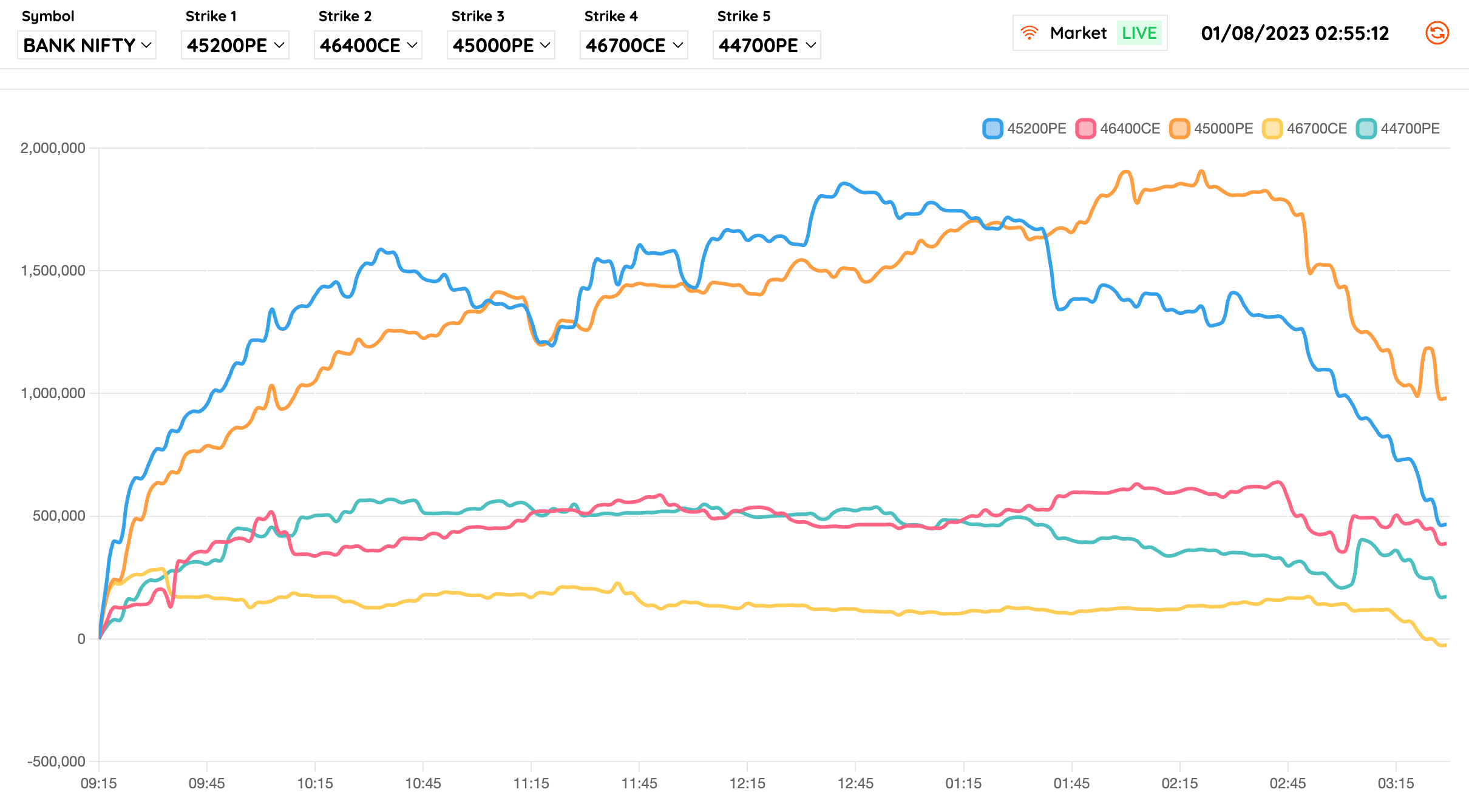

Trending Open Interest

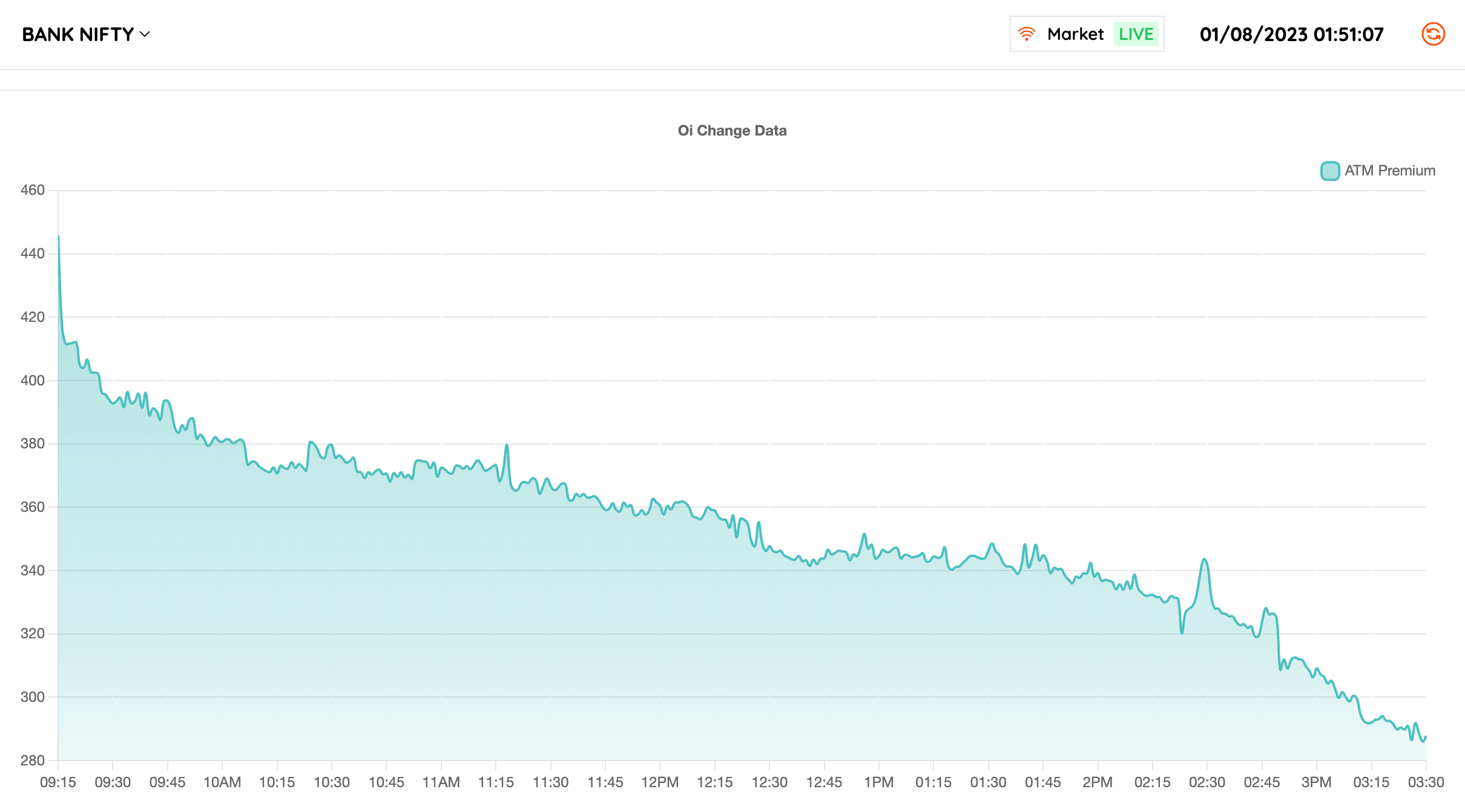

Open Interest Analysis

Call VS Put Open Interest

The right price for you

FAQ

What is Options Open Interest Tracking ?

Options open interest tracking refers to monitoring the total number of outstanding options contracts for a specific financial instrument at any given time. It helps investors and analysts gauge the market sentiment, liquidity, and potential price movements of the underlying asset. Increasing open interest indicates higher market participation and interest, suggesting potential trend continuation or reversal. Conversely, decreasing open interest might indicate a decline in market interest. By observing changes in open interest, traders can gain insights into potential shifts in market sentiment and make more informed decisions in options trading and risk management strategies.

Is it free to user trendingtick platform?

Absolutly its free to use ! You can use google account to login and enjoy site benafits.

What is Options Open Interest?

Options open interest refers to the total number of outstanding (unexpired) contracts for a specific options contract at any given time. It represents the cumulative total of buy and sell positions, providing insight into market liquidity and interest in that particular option. High open interest suggests greater market activity, leading to narrower bid-ask spreads, increased trading volumes, and higher liquidity. Traders often monitor open interest to gauge investor sentiment and identify potential price trends or turning points. Additionally, it aids in identifying heavily traded strike prices or expiration dates, influencing trading strategies and risk management decisions.

CALL options and PUT option?

A call option is a right to buy an underlying asset or contract at a fixed price at a future date but at a price that is decided today. On the other hand, the put option is the right to sell an underlying asset or contract at a fixed price at a future date but at a price that is decided today.

which securities your platform allows to track option interest?

For timebeing we give you Highly Liquid Nifty and Bank Nifty index option trading facilies.

On which Strike prices i can track open interest?

Mostly most +15 strike prices from the spot strikes price are available for open interest tracking as in real life this matters most to avoid any liqudation issues.

What is liqudation?

It means how likely you are able to SELL or BUY your assets in market.

Solution

Open Interest Tracking of options