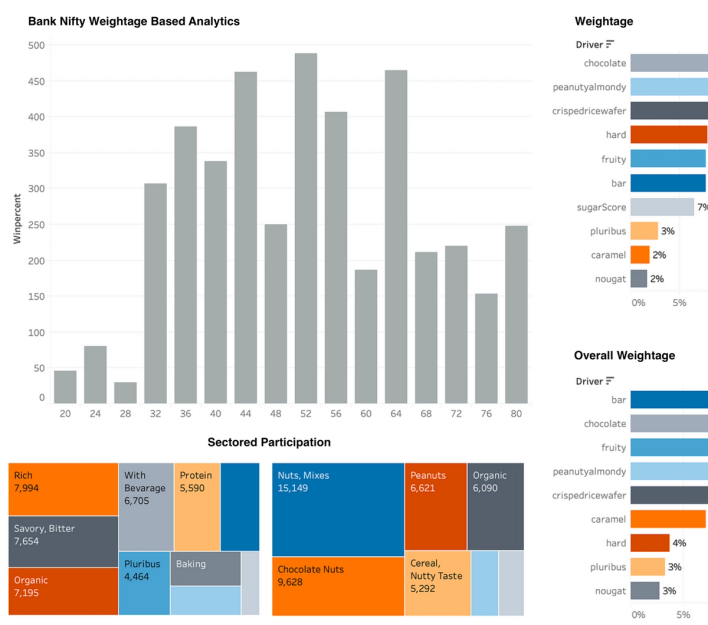

Bank nifty weightage based analytics

Analyzing the Bank Nifty stock

index based on its weightage

is a valuable strategy for

investors. This index comprises a

basket of banking stocks, and

the weightage of each stock

influences the index's performance.

CTO at TrendingTicks

A stock index, like the Bank Nifty in the context of India's National Stock Exchange (NSE), is a measure of the performance of a specific group of stocks. In this case, the Bank Nifty is designed to represent the banking sector in India. The performance of the index is driven by the performance of the individual stocks that make up the index. The weightage of each stock within the index plays a crucial role in determining the overall performance of the index. Here's a breakdown of how weightage-based analysis works for the Bank Nifty:

Selection of Constituent Stocks

The Bank Nifty is composed of a specific set of banking stocks listed on the NSE. These stocks are chosen based on certain criteria, such as market capitalization, liquidity, and sector relevance.

Weightage Assignment

Each stock in the Bank Nifty is assigned a weightage, which represents its relative importance within the index. The weightage is typically determined based on the market capitalization of the stock. Market capitalization is calculated by multiplying the stock's price by the total number of outstanding shares. Stocks with a higher market capitalization are assigned a larger weightage.

Calculation of the Index

The Bank Nifty index is calculated by adding the market values of all the constituent stocks, adjusted for their respective weightages. The formula for calculating the index is as follows:

Bank Nifty Index = (Stock 1 Market Cap x Weightage 1) + (Stock 2 Market Cap x Weightage 2) + ... + (Stock n Market Cap x Weightage n)

The index is usually expressed in terms of an index value, with a base value typically set at 1,000.

Impact on Index Performance

Stocks with higher weightages have a more significant impact on the Bank Nifty's performance. If a stock with a high weightage experiences a significant price change, it will have a more pronounced effect on the overall index. Conversely, stocks with lower weightages will have a smaller impact.

Rebalancing

The weightages of stocks within the Bank Nifty are not static and may change over time. Rebalancing occurs periodically, often quarterly or annually, to account for changes in the market capitalization of individual stocks. If a stock's market capitalization increases or decreases, its weightage in the index will be adjusted accordingly.

Interpreting Weightage-Based Analysis

Analysts and investors often use weightage-based analysis to assess the overall health and performance of the banking sector. Changes in the index's value can indicate the collective performance of the constituent stocks, and investors may use this information to make investment decisions.

Register on Dhan.co for free Bank nifty weightage based analytics

Conclusion

It's essential to note that weightage-based analysis is just one aspect of evaluating an index's performance. Other factors, such as economic conditions, government policies, and global events, can also impact the index. Investors and analysts should consider a broad range of information and indicators when making investment decisions related to the Bank Nifty or any other stock index.