Nifty open interest

Nifty open interest refers to

the total number of open

or outstanding futures and options

contracts on the Nifty 50

index, which is the benchmark

stock market index in India.

Open interest is a key

metric that traders and investors

use to gauge market sentiment

and potential price movements.

Principal Evangelist at TrendingTicks

Open interest represents the total number of contracts that have not been closed or offset by an opposing trade. It is a useful indicator because it provides insight into the liquidity and popularity of a particular index or stock.

Here are some key points about Nifty open interest:

Long and Short Positions

Open interest can be associated with both long (buy) and short (sell) positions in futures and options. For each long contract, there is a corresponding short contract, so the total open interest is always balanced.

Changing Open Interest

An increase in open interest often indicates new money flowing into the market, suggesting growing bullish or bearish sentiment. A decrease in open interest can imply that traders are closing out positions, potentially signaling a change in market sentiment.

Price Movement

Traders often use open interest along with price movements to make trading decisions. For example, a rising Nifty index with increasing open interest may suggest a strong trend, while declining open interest alongside price movement may indicate a weakening trend.

Liquidity and Volume

High open interest generally implies greater liquidity and trading activity in the Nifty 50 index, making it easier to enter and exit positions without impacting prices significantly.

Expiration

For options contracts, open interest can be particularly significant as options contracts have expiration dates. Traders may focus on open interest in options with upcoming expirations to gauge market expectations and potential price movements.

Conclusion

To access current Nifty open interest data, you would typically refer to financial news sources, brokerage platforms, or exchanges that provide real-time information on the Nifty 50 index and its derivatives. Open interest data is updated regularly throughout the trading day and is one of many tools traders use to make informed decisions in the financial markets.

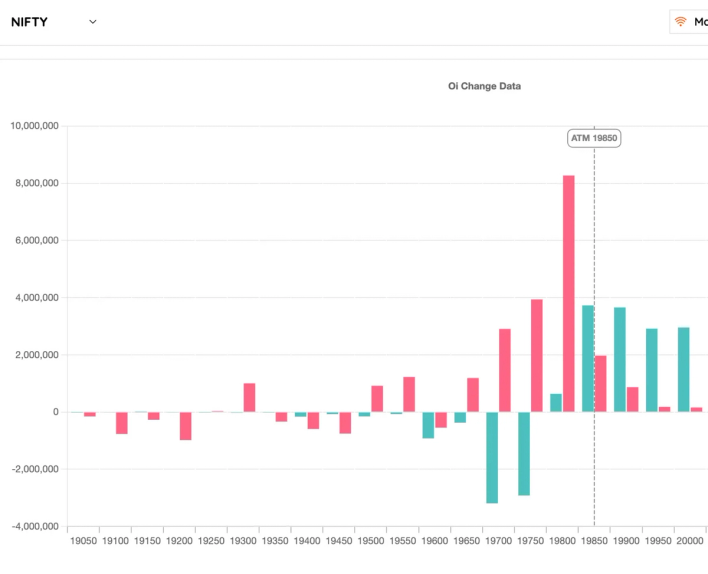

You can also access our platform to access a live nifty open interest chart.