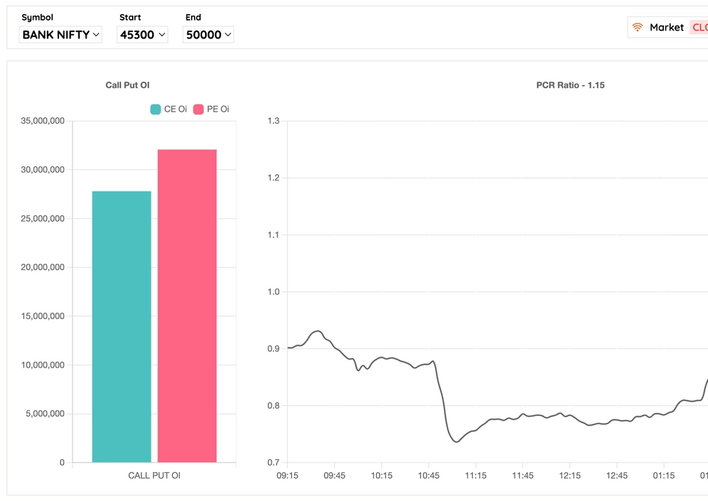

Pcr ratio bank nifty today

The Put-Call Ratio, also known

as the PCR, is a

financial metric that compares the

trading volume of put options

to call options within a

specific market or for a

particular security, such as a

stock or an index. Put

and call options are financial

derivatives that give investors the

right, but not the obligation,

to buy (call option) or

sell (put option) a specific

asset at a predetermined price

within a certain period.

Principal Evangelist at TrendingTicks

The Put-Call Ratio, often referred to as the PCR, is a popular indicator used by traders and investors in the options market to gauge market sentiment and potential market direction. It is calculated by dividing the total open interest of put options by the total open interest of call options for a particular underlying asset. Here's how it works and how it can be helpful in trading options:

Understanding Put and Call Options

Put Option

A put option gives the holder the right, but not the obligation, to sell a specific asset (like a stock or an index) at a predetermined strike price before or on a specified expiration date.

Call Option

A call option gives the holder the right, but not the obligation, to buy a specific asset at a predetermined strike price before or on a specified expiration date.

Calculating the Put-Call Ratio

To calculate the put-call ratio, you need to sum the open interest of all put options and divide it by the sum of the open interest of all call options.

The formula of PCR

Put-Call Ratio = Total Open Interest of Put Options / Total Open Interest of Call Options

Check Bank NIFTY PCR ratio live today

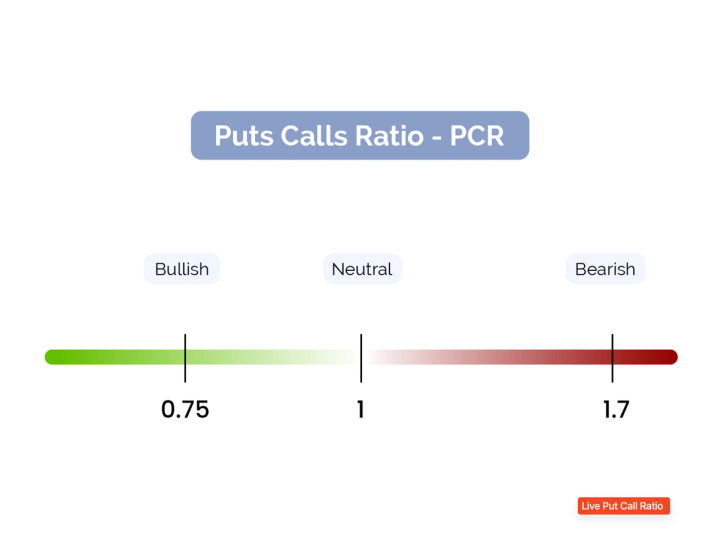

Interpreting the Put-Call Ratio

- The put-call ratio is often used as a contrarian indicator. It is believed that extreme readings in the ratio can signal potential market reversals.

- A high put-call ratio (greater than 1) suggests that there is more open interest in put options relative to call options. This can indicate a bearish sentiment, as more traders are betting on a market decline.

- A low put-call ratio (less than 1) suggests that there is more open interest in call options relative to put options. This can indicate a bullish sentiment, as more traders are betting on a market rise.

- It's important to consider the context and historical data when interpreting the ratio.

- A single reading might not be very informative; it's more useful when tracked over time and in comparison to historical levels.

Using the Put-Call Ratio in Trading

- Traders and investors can use the put-call ratio to confirm or challenge their trading decisions.

- When the ratio is at extreme levels, it may signal that the market sentiment is excessively bearish or bullish, which could be an opportunity to take a contrarian position.

- Additionally, changes in the put-call ratio over time can provide insights into evolving market sentiment, potentially helping traders make more informed decisions.

Conclusion

Keep in mind that while the put-call ratio can be a useful tool, it should be used in conjunction with other technical and fundamental analysis methods to make well-informed trading decisions. Trading options involves significant risks, and it's important to have a solid understanding of options and the underlying asset before using the put-call ratio as part of your trading strategy.