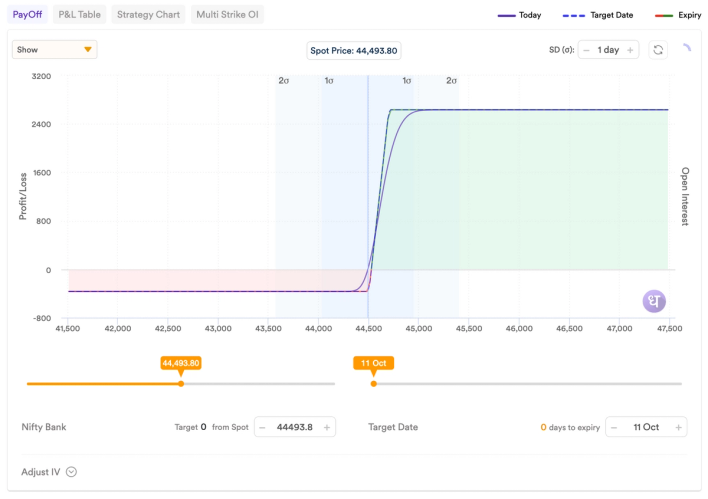

What is straddle chart

Estimate the profit and loss

chart by selecting strike prices

which can be purchased simultaneously

of options to buy and

sell a security or commodity

at a fixed price, allows

the purchaser to make a

profit whether the price of

the security or commodity goes

up or down.

Principal Evangelist at TrendingTicks

The straddle strategy is an options trading strategy that involves purchasing both a call option and a put option with the same strike price and expiration date. This strategy is employed when an investor expects a significant price movement in the underlying asset but is uncertain about the direction of that movement.

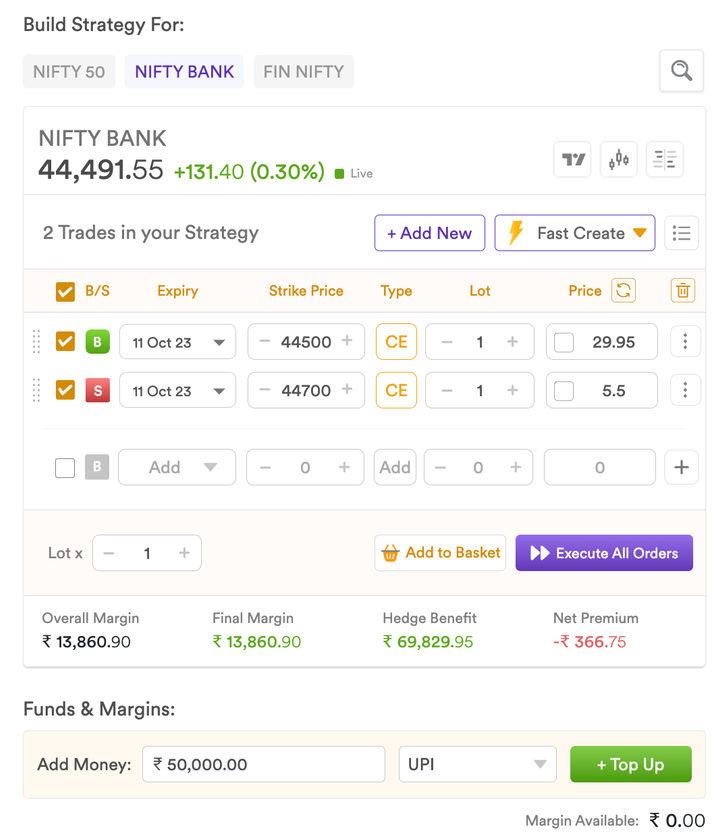

You can monitor live chart on Dhan.co website

Dhan.co provides this feature out of the box to calculate run time profit and loss. They show this profit and loss in chart form with a live feed.

Register on Dhan.co for free straddle chart analytics

Here's how the straddle strategy works

Buy Call Option

An investor purchases a call option, which gives them the right (but not the obligation) to buy the underlying asset at a specified strike price before the option expires.

Buy Put Option

Simultaneously, the investor buys a put option, which gives them the right (but not the obligation) to sell the underlying asset at the same strike price before the option expires.

Same Strike Price and Expiry Date

Both the call and put options have the same strike price and expiration date. This is a key feature of the straddle strategy.

The idea

The idea behind the straddle is that it profits from a significant price movement in the underlying asset, regardless of whether it moves up or down. The potential scenarios are as follows:

If the Price Rises

The call option may generate profits as the investor can buy the asset at a lower strike price and sell it at a higher market price.

If the Price Falls

The put option may generate profits as the investor can sell the asset at a higher strike price, even if the market price is lower.

If There's Significant Volatility

The straddle benefits from increased volatility. If the price makes a significant move in either direction, one of the options will likely be profitable enough to offset the loss on the other option.

Choose strike prices for profit margins

Risks and Considerations

Costly Strategy

Since the investor is buying both a call and a put option, the initial cost of the straddle can be relatively high.

Requires Significant Price Movement

For the straddle to be profitable, the underlying asset needs to experience a substantial price movement. If the price remains relatively stable, both options may lose value, leading to a net loss.

Time Decay

Options have a time limit, and their value decreases as they approach expiration. If the expected price movement doesn't occur within the given time frame, both options may lose value.

Conclusion

The straddle is a strategy that is often used by traders in anticipation of significant market events, such as earnings announcements or economic reports, where there is an expectation of high volatility. It's important for investors to carefully assess the risks and potential rewards before implementing a straddle strategy.